Fiduciary-Duty

Hiring a financial advisor can cause a considerable amount of anxiety; after all, it’s your hard-earned money we’re talking about here. It’s important to seek out somebody who thinks critically, treats this specialized work as a highly-skilled craft, and seeks always to improve. Although not all financial advisors are the same, it’s a general term that can mean many different things and come in many different forms.

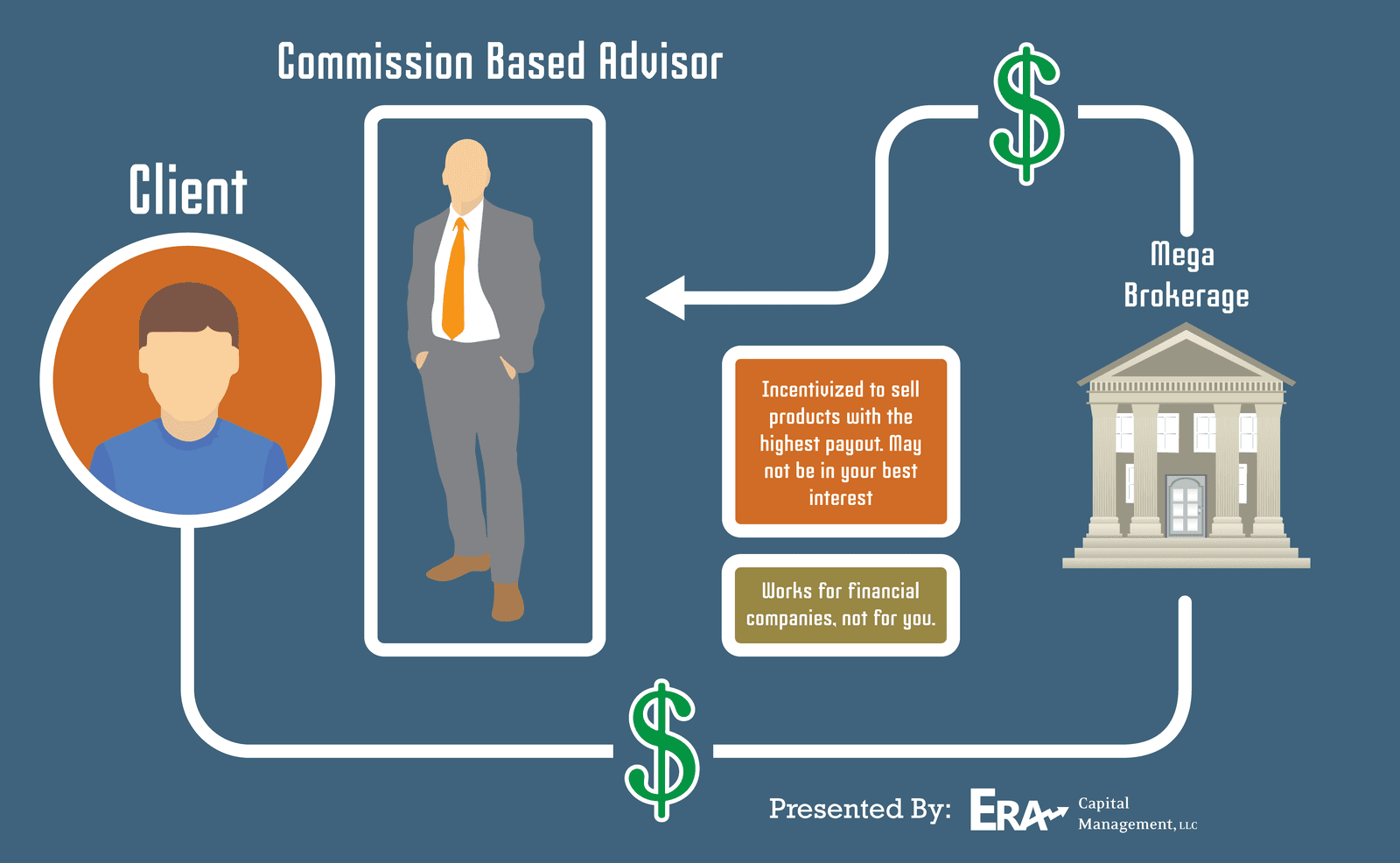

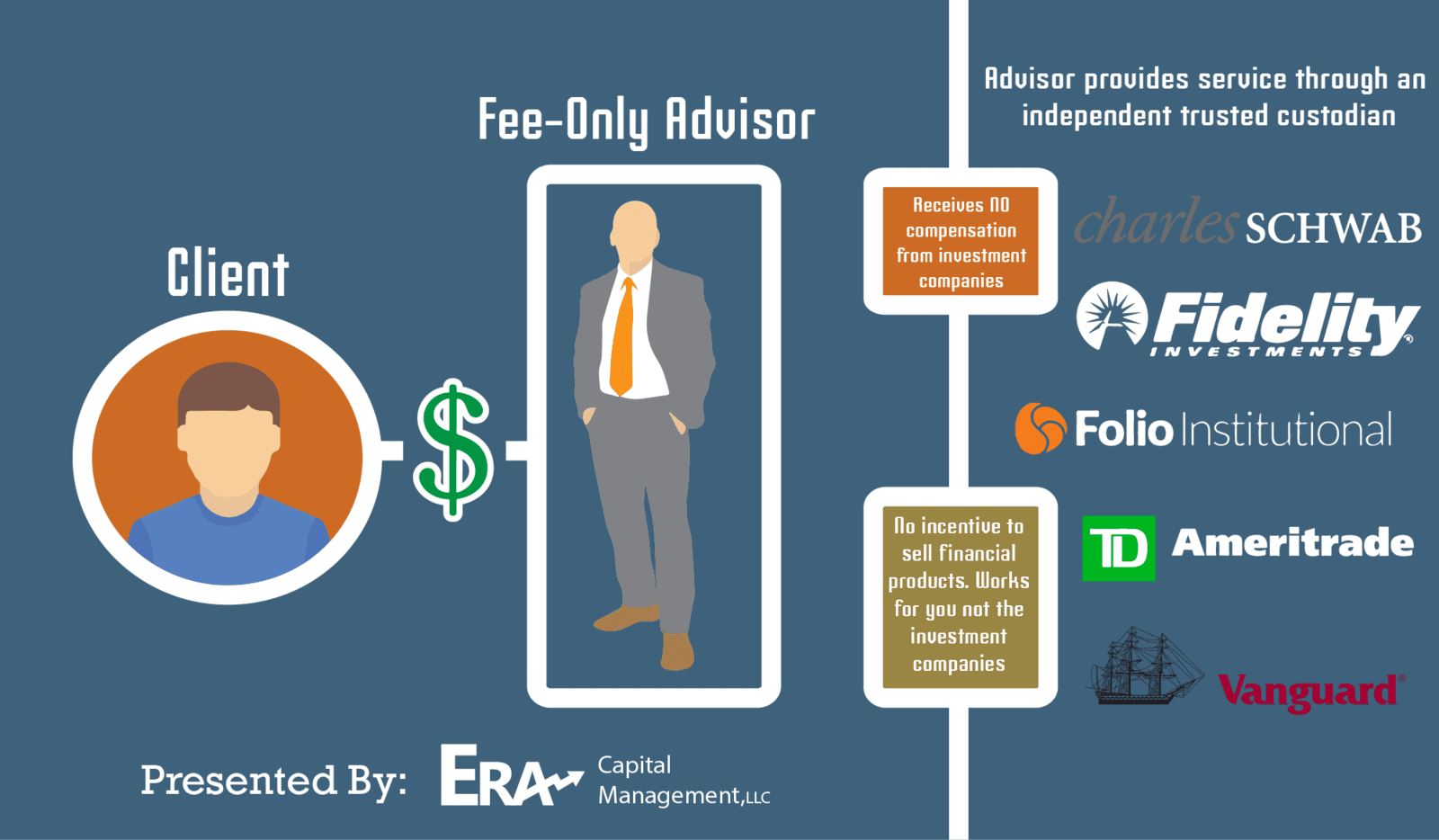

Compensation trends to drive motivation, so it’s important to understand the difference between the commissions-based broker and fee-only investment advisor. How your adviser is compensated is an important factor in determining what kind of advice you’ll receive. Building relationships means building trust and being up front and transparent is critical.

The way one is compensated has a dramatic impact on the advice given. Motivations between parties can vary dramatically and may not always be aligned. Some people just want to close a sale and make some quick bucks. Some – whether a broker or an advisor – choose to educate and inform and inspire, encourage you to reach higher, and provide a valuable service that develops into an ongoing process.

In both cases, fee-only or broker/dealer, you pay for the advisor’s services. Either way, as an investor seek advice from someone you know and trust.

Fee-Only Financial Advise and the Fiduciary Standard

This means we never receive referral fees or commissions, and therefore have no incentive to push one product over another. We simply advise on the what’s the best investment for your situation. This compensation structure aligns our goals with yours, which is to focus on the indented goal of growing your wealth.

Commission Based Financial Advise and the Suitability Standard