Professional Investment Management

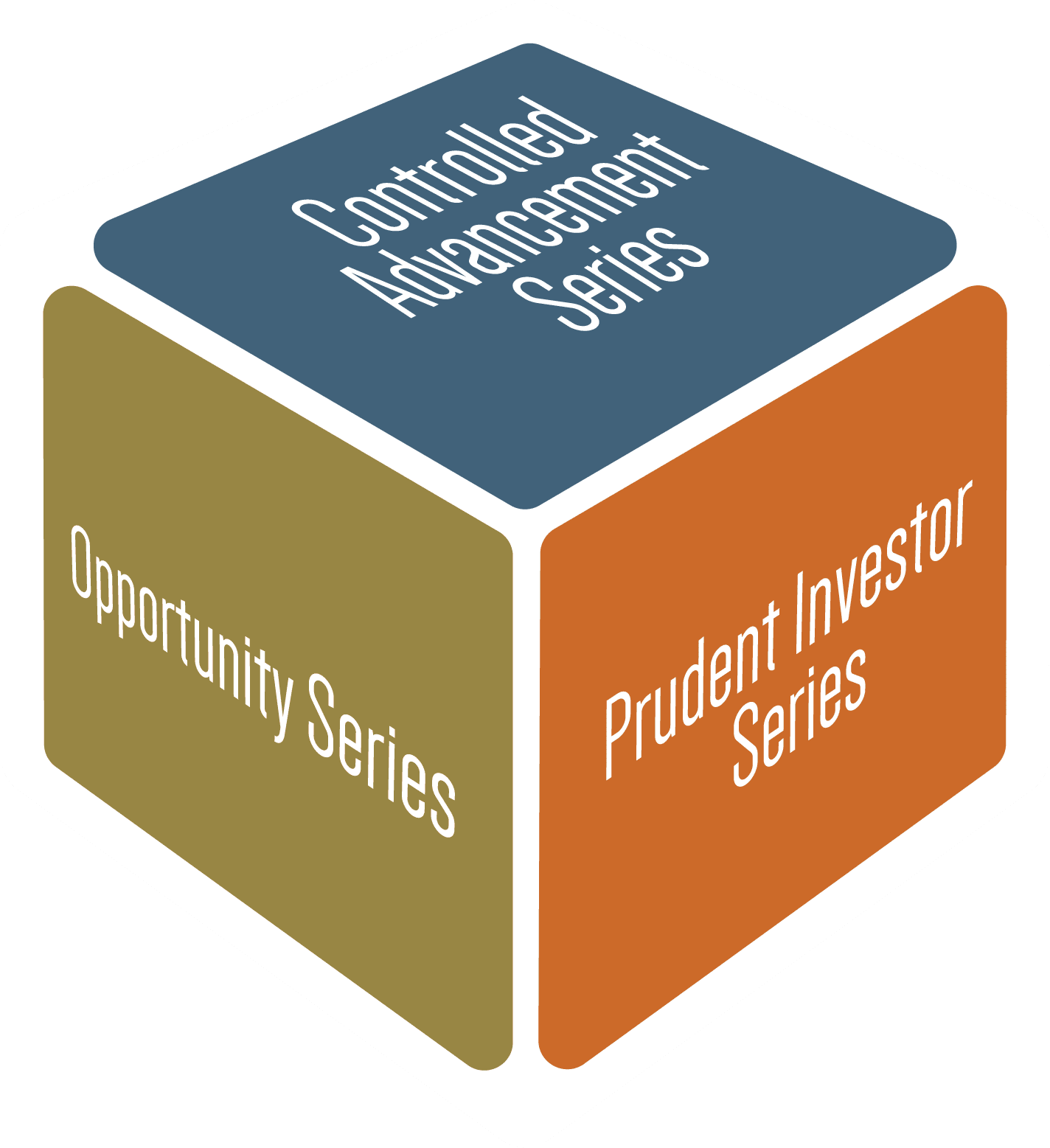

Three-Dimensional Approach

Custom, in-house managed portfolios that go beyond standard diversification—adding real depth and adaptability to build resilience and give you greater peace of mind over the long term.

Era Capital Management builds your investment accounts through a disciplined, model-based portfolio management process—all models designed and actively managed in-house by your advisor.

We elevate traditional diversification and risk management with our three-dimensional investment approach, adding meaningful length and depth to your portfolio for greater resilience and opportunity capture. This active, adaptive process is built to thrive in a constantly changing market environment—guided by logic, data, and systematic discipline rather than emotional reactions.

Each of our three specialized series—Opportunity, Controlled Advance, and Prudent Investor—is carefully crafted to handle risks and pursue opportunities in distinct ways, using clear disciplines tailored to different investor profiles and market conditions.