Not all financial advisors are created equal. Many of the nationally known investment firms use tiered fee structures which could be costly over time.

When I get the opportunity to meet with new clients and review their current portfolios I’m often troubled by the sneaky ways clients end up being charged more than I think they should. A lot of people put more trust in larger firms because of name recognition. However, it’s these well-known investment and brokerage firms that are the most pervasive at creating confusing and costly fee structures. What is known as tiered investment advisory fee structures are disingenuous and clients are not fully aware how the fee calculations work.

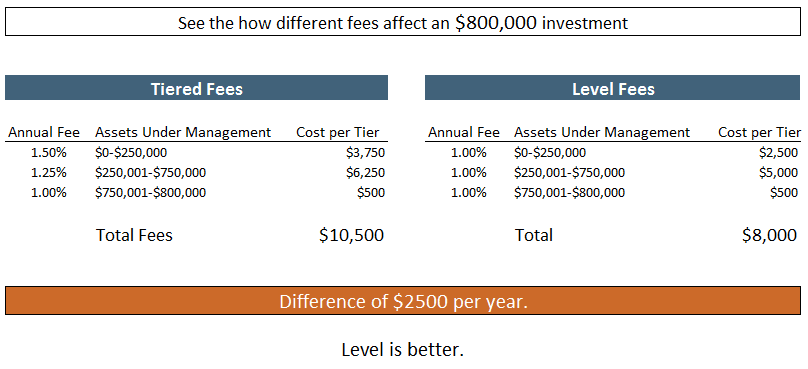

When you buy in bulk or in higher volumes you may ask for a certain discount for doing so. This is also true in the financial services industry. Just about every investment advisory firm offers reduced rates for larger accounts known as breakpoints. The breakpoint schedule is used to determine when a fee reduction is obtained. Once a breakpoint is obtained there are two ways in which the discount can be applied: Tiered or Level. Let’s analyze the difference between the two methods

This represents a simplified comparison of an $800,000 account and the estimated savings a level fee structure provides.

Under the tiered plan only $50,000 of the $800,000 total actually receives the lowest rate. On the other hand using the level fee method every dollar receives the lowest tier which can mean significant savings over the long term.

I encourage everyone to do their due diligence, check your current advisory agreements and ask questions to see if you’re being charged using a tiered fee schedule. If you would like to get a second opinion contact us for a complementary review of your accounts.